CASE STUDY

Validation of Credit Risk Models at a Belgian Bank

Model Risk Management (MRM) is becoming a leading priority for Financial Institutions and demands robust and transparent model validation capabilities and controls, anchored with formalized MRM governance. As regulatory scrutiny and reliance on models is growing in nearly all functions within the organisation, FIs are realizing that poor execution of MRM can lead to a failure to meet regulatory requirements and financial and reputational risk.

In this case study, we detail how a prominent Belgian bank utilized Chiron App to enhance their model validation process, streamline regulatory reporting, and automate repetitive tasks.

SMALL VALIDATION TEAM

The bank is committed to practising effective MRM by enforcing model risk policies that ensure full compliance with the SR11-7 guidelines for MRM.

REPETITIVE WORK

For IRB models, in particular, the same tests are required to be performed with some periodicity. Through automation, the bank aims to free up time for Subject Matter Experts to focus on more complex tasks.

REGULATORY REPORTING

Regulatory requirements for IRB models mandate periodic validation and reporting, necessitating the ability to accurately reproduce past outcomes by delving into historical data.

The Challenges

The bank sought a technology to streamline its model validation process, improve efficiency, and alleviate capacity constraints resulting from an expanding model inventory. Validation backlogs and delays mount as the small validation team struggles to cover expanding validation requests and address regulatory requests.

The Solution

The bank has opted for a SaaS deployment of Chiron App to enhance the validation process of their credit risk models such as Probability of Default (PD) and Loss Given Default (LGD).

Chiron App enabled the model validation team to make validation processes more efficient, reduce time spent on repetitive activities and facilitate regulatory reporting. The solution enabled more frequent and comprehensive testing, and allowed SMEs to focus on more complex quantitative tasks.

TIME-SAVINGS

The use of automation has significantly reduced the time spent on repetitive tasks by a factor of 10, allowing the team to conduct more in-depth analyses, delve deeper into the data, and validate a wider range of models.

AUDIT TRAIL

Through versioning and keeping the linkage between Model Risk Management objects in Chiron App, the internal validation unit can easily trace back to past results, reproduce them, and respond to regulatory inquiries.

BETTER TESTING

The bank can focus on more in-depth quantitative analyses and investigate model issues more efficiently. With Chiron App, they can now source data independently (from the first line) and have control over the full cycle.

The Yields Advantage

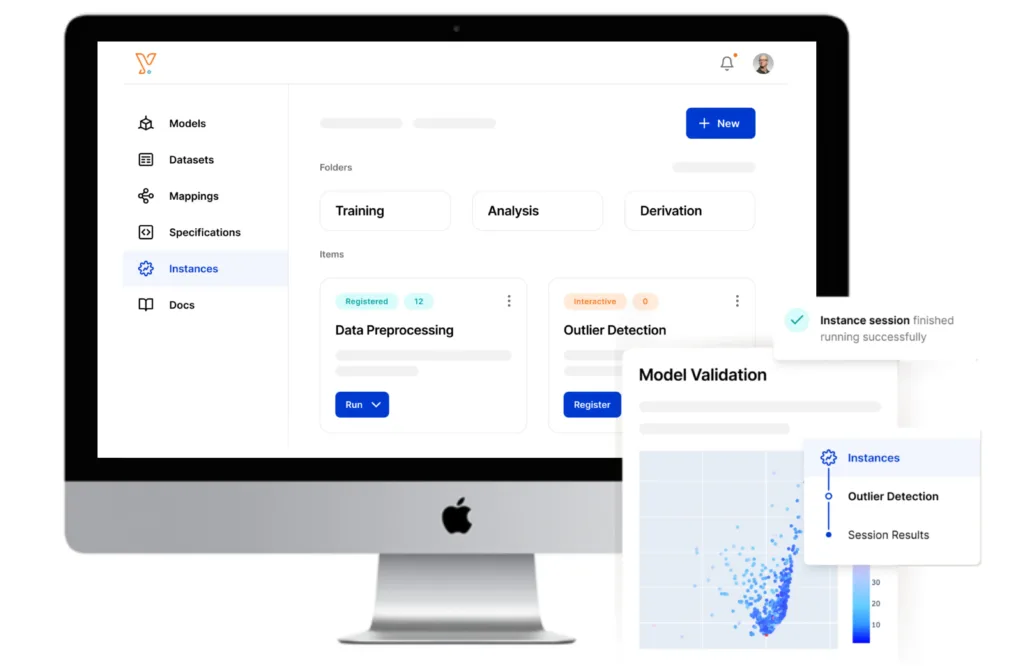

Yields.io provides an end-to-end Model Risk Management platform to automate MRM activities and reduce model risk. The platform consists of two technologies: Chiron App & Chiron Enterprise.

Chiron Enterprise is a customizable model inventory and workflow management tool that streamlines the execution of end-to-end Model Risk Management processes.

Chiron App is a modular data science platform that automates all quantitative model testing and documentation.

Ready to transform your business? Let’s talk. Contact our sales team at yields.io/contact

In 2022, Yields.io has won the ‘Model Validation Service of the Year’ award at the Risk.net technology awards for the fourth year in a row. Yields.io is widely recognised as a technology leader in MRM, and is supported by global partners such as KPMG and IBM.

Simon Vanooteghem

Director of Sales

Efrem Bonfiglioli

Solution Engineer