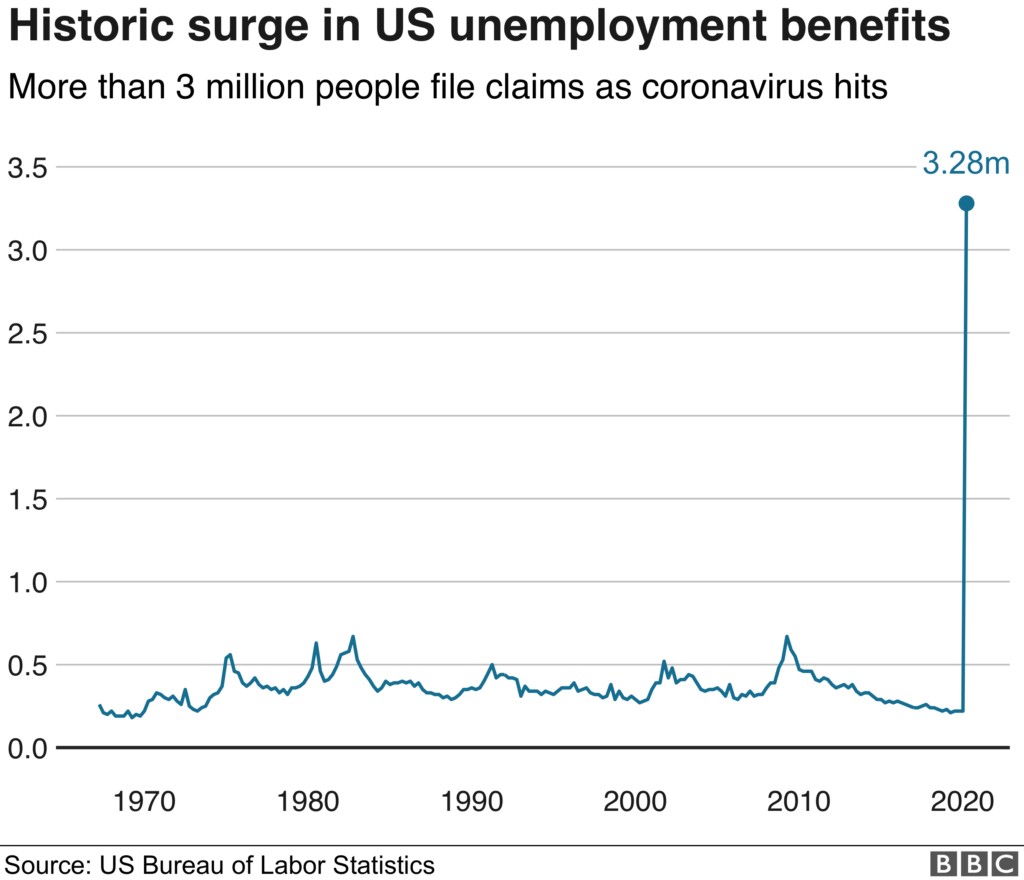

In an attempt to deal with the Covid-19 outbreak, the world has abruptly come to a halt. What will happen next is all but certain, but now that some countries see a gradual improvement in the rate of infections, policymakers are starting to work on exit scenarios. However, as many scientists have already indicated, the period ahead is going to be rather volatile. This due to social distancing measures that might have to be re-applied in case a secondary wave of infections would appear.

Trying to predict the impact of these measures on the economy is hard. This because the signature of this crisis is very peculiar. No other financial crisis is representative of the current Covid-19 pandemic. This is particularly challenging for credit models that have to forecast the evolution of creditworthiness. Failure to predict the probability of default accurately will lead to heightened loss provisioning and increased capital requirements. This is why proper model risk management at this very moment is critical.

Forecasting accurately in the current crisis is hard for a few distinct reasons. Apart from the primary reason that we don’t have representative scenarios, there are a few other issues that always pop up in the realm of sudden economic disaster. First of all, many financial institutions rely on so-called through-the-cycle models. These use a long term average to estimate the probability of default. As long as we are in a regular economic cycle with gradual up- and downturns, this average is a good estimate.

However, now that the economy has abruptly hit the pause button, long term averages are a poor approximation. Secondly, many institutions are using first-generation IFRS 9 models to compute expected credit exposures. These models have not yet weathered the storms of other financial crises. Therefore might not behave in a very stable and reliable way. This then leads to augmented PnL volatility and overly conservative loss provisions.

Dealing with the challenges through proper model risk management

In order to deal with these challenges, proper model risk management is key and banks have to focus on two aspects: scenario generation and benchmarking. Regarding scenarios, institutions have to build dedicated stress scenarios to simulate the months ahead. Moreover, incorporate the large uncertainty that we are facing today. This, while also taking into account the various economic measures that governments are putting in place. A good starting point for creating such scenarios is the basic epidemiological models. For instance, SEIR models, together with a dynamic control strategy to manage the evolution of the outbreak.

Regarding benchmarking, comparison with alternative models is very important to better understand the impact of various assumptions. Ultimately, decision makers are interested in understanding the impact on capital and provisioning. However, it might be impractical to actually replace the credit models that are used in these computations because they might have many dependencies and can be deeply embedded in IT systems. In these situations, we suggest to use so-called surrogate models. Surrogate models are simplifications that are used to approximate the behaviour of a more complex modelling framework. In the present case, we could build a surrogate model to estimate the change in capital consumption based on changes in the macro-economic situation.

When applying proper scenario analysis and benchmarking, limitations of the existing credit models will be discovered and this will prompt modifications to the production algorithms. These will then have to be validated which will lead to a surge in validation work. At that point, having an additional capacity in model validation through automation will be crucial. Chiron, Yields’ platform for automated model risk management, is being used today to manage these challenges.

An enterprise solution for model risk management

In Chiron, users can create benchmark models and build surrogate models. In addition, we have developed a Covid-19 specific scenario generator to study the near and long term impacts on credit models. On top of that, Chiron allows for the automation of many model validation tasks to help industrialize independent review, which is necessary to deal with the flood of validation requests triggered by modifications to the existing models.

In conclusion, the present pandemic is a real-life stress test for credit risk models. To deal with this, proper model risk management is key.

Interested in learning more? Download here our whitepaper The Evolution of Model Risk Management.